The tax return and your investments - everything you need to know

In this guide, we'll tell you when the documents for your tax return are available, where you can find them and what taxes are levied. Chill the champagne - with neon, you can submit your tax return in a flash.

When will I receive my tax statements?

The tax statements for your main account and your Spaces will be available as a PDF in the app by the end of January at the latest. For all those who use invest, it's worth waiting until February. Because they will receive the documents as an e-tax statement in 2024.

Tax statement main account + Spaces

- Format: PDF

- Date: By the end of January at the latest

- Name: Tax statement accounts 2023

eTax statement main account, Spaces + invest

- Format: eTax statement for tax portals such as eTax or TaxMe-Online

- Date: End of February

- Name: Tax statement trading 2023

From the end of February: eTax statement for invest, Spaces and main account

Do you use neon invest? Then you will receive the document for your tax return at the end of February in the practical eTax format. The eTax statement is also the tax statement for your main account, your Spaces and your investments. It is free of charge for everyone who uses neon invest.

With the eTax statement, you no longer need to enter the figures manually in your tax return: download the document from the app and upload it conveniently to eTax. Thanks to the barcodes, your data is automatically transferred to the tax return. That's it!

Almost all cantons support eTax - so your tax return is done in a flash.

Where can I find the documents for my tax return?

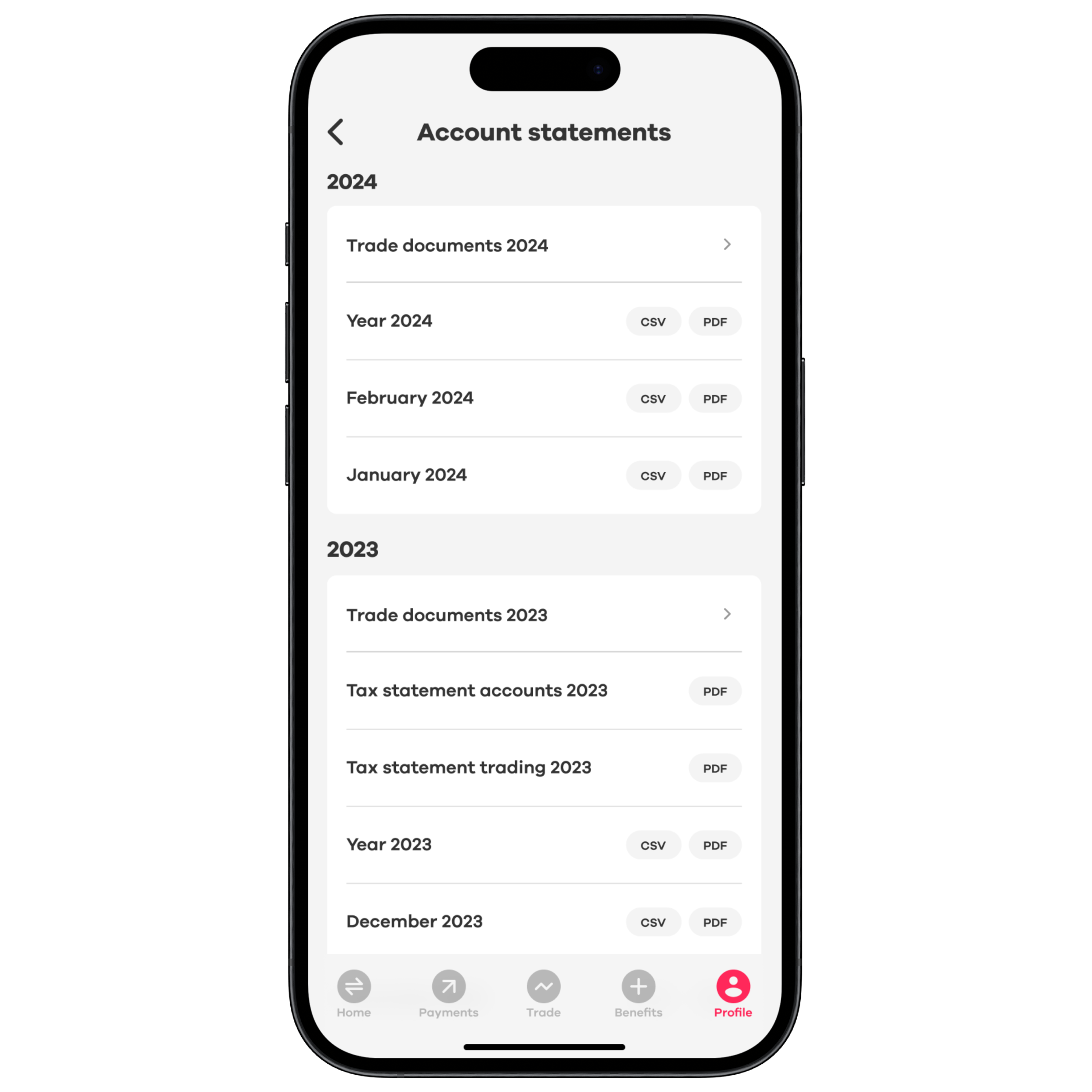

Tap on «Profile» at the bottom right of the app and then on «Account statements». Here you will find the PDF «Tax statement accounts 2023» for the main account and Spaces as well as the eTax statement «Tax statement trading 2023» for the main account, Spaces and invest. Please note that the Spaces are labeled as «Neon Projekte» on your tax statement.

What taxes are levied?

In Switzerland, you pay wealth tax and income tax on your investments. The wealth tax applies to your entire neon account: Main account, Spaces and invest. Income tax, on the other hand, is only levied on dividends that you receive via your investments on neon invest.

Yield

Under Swiss tax law, as a private investor you do not have to pay tax on capital gains. It therefore makes no difference to your tax bill whether you sell your investments at a profit or a loss or whether you hold them in your portfolio while they gain or lose value.

Dividends

Dividends, on the other hand, are considered income in Switzerland and are therefore subject to income tax. Dividends usually only make up a small percentage (approx. 1%) of your investment amount. Income tax is deducted from the distributed or reinvested dividend amount; the income tax rate applied depends on your tax progression and your place of residence.

What is the source and the withholding tax?

Depending on the domicile of the security, further taxes are payable on the income (especially dividends): For securities domiciled in Switzerland (ISIN begins with CH), it’s the withholding tax and amounts to 35%. Abroad it is called a source tax and the amount differs from country to country. Your income will always be credited to you after this tax has been deducted (you can see this on your receipt by clicking on «Profile» in the app, then on «Account statements» and «Portfolio document»). You will then find the total for the year on your tax statement (also under «Profile» in the app).

You may be able to offset some or all of this tax on your tax return. Read on to find out how:

Can I reclaim the withholding tax?

Withholding tax on dividends and interest is levied by the federal government directly at the bank. Withholding tax of 35% is deducted directly from CHF 200 or more in interest. If you declare your bank accounts and securities correctly, you will receive the withholding tax back. As a rule, the amount owed will be deducted from your cantonal tax bill.

Can I reclaim the source tax on foreign securities?

If Switzerland has a double taxation agreement, the withholding tax can usually be reclaimed using the DA-1 form. However, the Swiss tax authorities will only consider the DA-1 form if the reclaimable value is higher than CHF 100 (at 15% withholding tax). This means that your portfolio must pay out more than CHF 600 per year in dividends from foreign shares.