How Switzerland's three-pillar system works

Nov 17, 2025

To ensure that people in Switzerland are financially secure when they retire, the pension system is based on a clear and proven principle: the three-pillar system. Here we explain how this pension system works and why it is relevant to you.

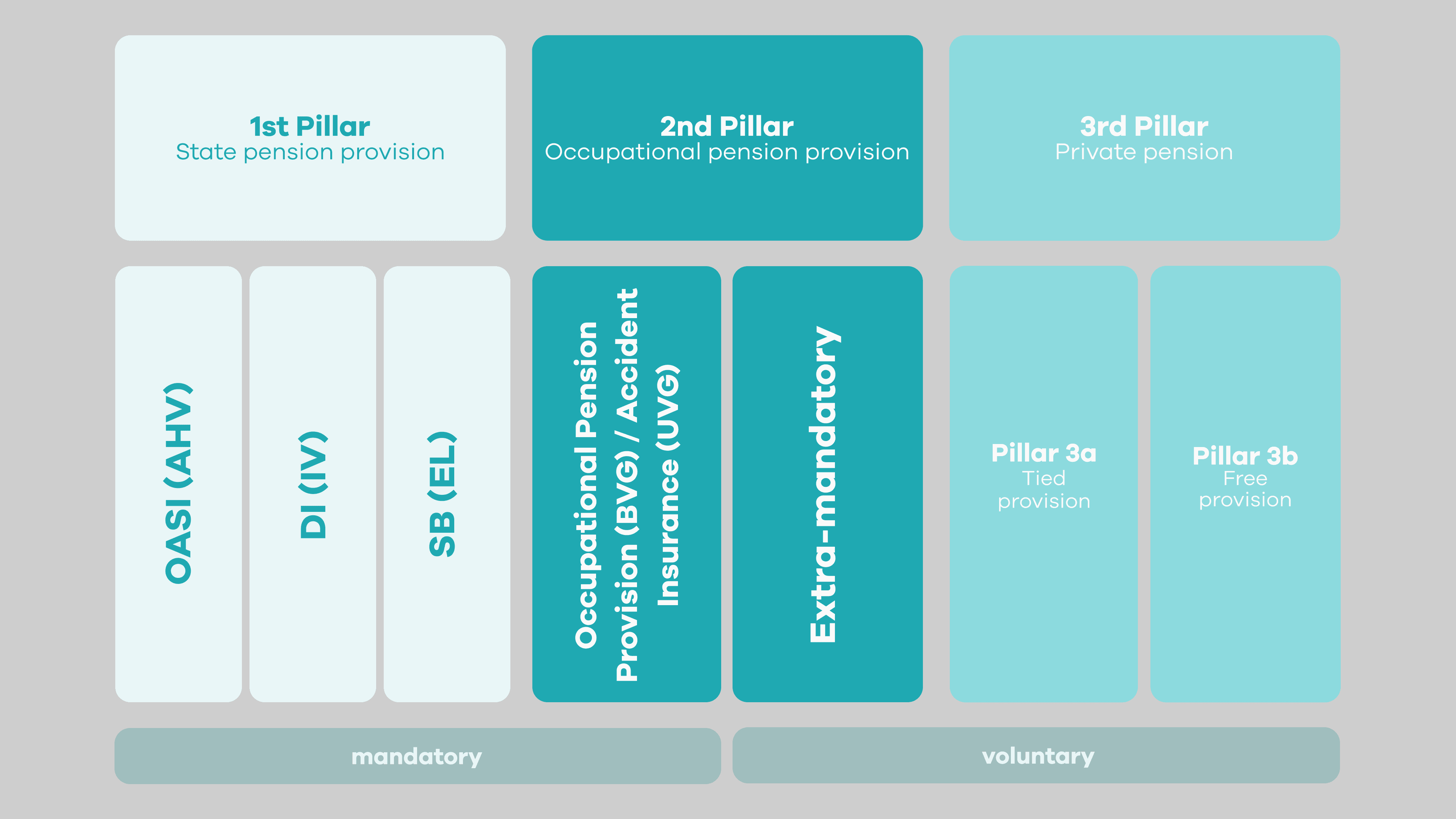

In Switzerland, pension provision is based on a three-pillar system and ensures that people in Switzerland are financially secure in old age, in the event of disability or in the event of death. State and occupational pension provision (1st and 2nd pillars) are compulsory and are supplemented by private, voluntary pension provision (3rd pillar). These three pillars are interlinked and together form the foundation of our social and financial security.

1st pillar: state provision

The 1st pillar includes the Old-age and Survivors' Insurance and Disability Insurance (OASI/DI in English, AHV/IV in German), as well as the so-called Supplementary Benefits (EL in German). It secures the existence of insured persons in old age, in case of disability, or in the event of death. Supplementary benefits step in when other state benefits or one's own income are not sufficient.

In short: Anyone who lives or works in Switzerland is automatically insured. The 1st pillar covers the essentials, but is not sufficient to maintain the accustomed standard of living.

2nd pillar: occupational pension provision

The 2nd pillar forms the occupational pension provision (BVG in German), often simply called «pension fund». It complements the benefits of the 1st pillar and ensures that you can continue your accustomed lifestyle in old age or in the event of disability. In the event of death, it also provides financial support to your dependents.

All employees with an income over 22'680 CHF (valid amount for 2025) are automatically insured through the pension fund. Self-employed individuals can also voluntarily join a pension fund. Therefore, the 2nd pillar, like the 1st pillar, is mandatory, but extends the coverage as another level for your financial safety net in old age.

Good reasons for a third pillar

You might now be asking yourself: Why do I still need a third pillar? Well, because when you're retired, the first two pillars usually cover only about 60% of your accustomed salary. And if you want to retire before 65, this percentage is even lower.

The voluntary third pillar closes this gap. It is divided into pillar 3a and pillar 3b:

Pillar 3a: tied pension provision

Pillar 3a primarily serves as old-age provision and is promoted by the Confederation through tax incentives. Contributions are possible up to a predetermined maximum amount and can be deducted from your taxable income. Furthermore, the accumulated pillar 3a assets are exempt from the wealth tax. Your money remains tied until retirement, hence the name «tied pension provision».

Pillar 3b: flexible pension provision

Pillar 3b offers more flexibility and complements pillar 3a. You can invest the money in various forms, for example, in a savings account, in funds, shares, or in ETFs. Since there are no annual maximum contributions or contract terms, you have more flexibility, but the contributed amounts are not exempt from tax.

The third pillar at neon

Because the third pillar is so important, it goes without saying that neon offers it too. And as always, we have made it simple, transparent and affordable.

neon pillar 3a

With neon Pillar 3a, you can plan for the future in a relaxed and affordable way – seamlessly integrated into your neon app. But see for yourself: you can find all the information about our Pillar 3a here. And if you're interested in how we compare with other 3a providers on the market, you can read our 3a comparison here.

neon pillar 3b

With neon invest, you can easily and affordably cover flexible pension provision, whether you want to save some extra for private projects or supplement your old-age provision. You can invest in shares or ETFs yourself, use investment plans to invest automatically on a monthly basis, or use our templates – our ready-to-use savings plans that make it easier for you to get started with investing.